Funding for the Early Years and Childcare Entitlement

Tax-Free Childcare

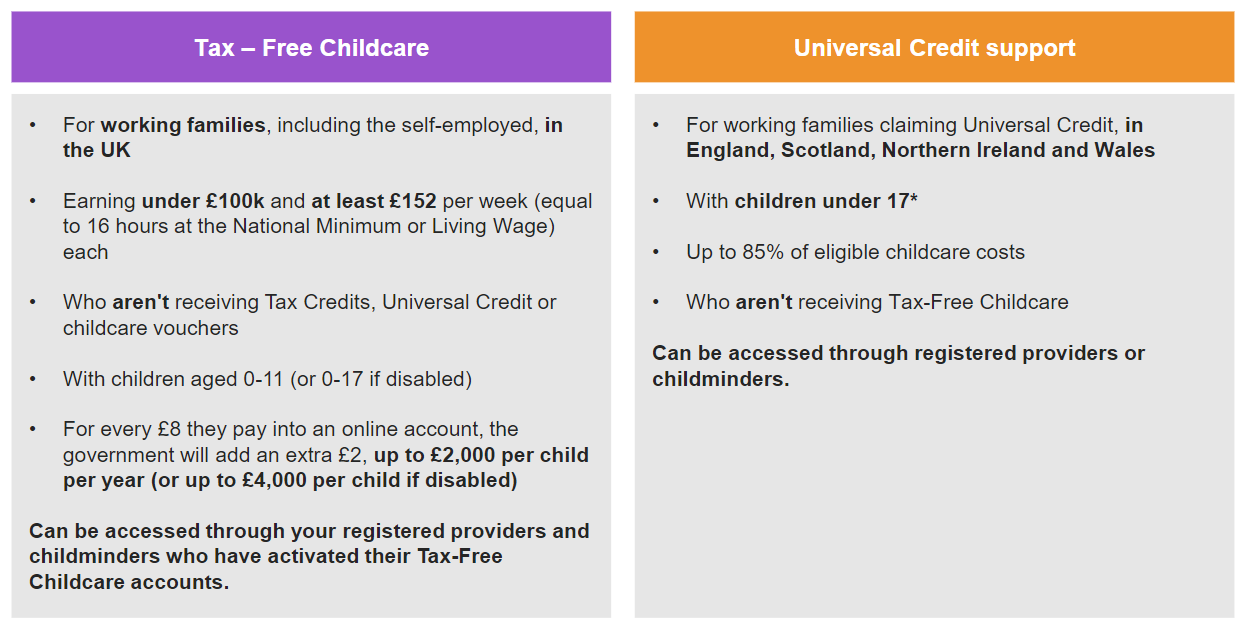

Tax-free childcare offers parents’ financial support towards their childcare costs. For every £8 a parent pays in, the government will add an extra £2. Parents can receive up to £2,000 or £4,000 for a disabled child.

Eligible parents entering the scheme will open an online childcare account that they can use to pay providers for childcare. When parents set up their account, they will receive an 11 digit reference number, which will show on the provider’s banking as a reference for the parent’s payment. To sign up to receive payments through the scheme, click the following link:

Eligibility

- Parents who are working and earning the equivalent to 16 hours on the National Minimum or Living Wage with children under 12 (or under 17 for disabled children).

- If either parent is on maternity, paternity or adoption leave, or is unable to work because they are disabled or have caring responsibilities, they could still be eligible.

Sign up to offer tax-free childcare

Sign up to offer tax-free childcare

For newly registered providers An email invite will be automatically generated to the provider to sign up for the tax free childcare, once HMRC have received registration confirmation.

For established providers Please use the following link to sign up to offer tax-free childcare: https://childcare-support.tax.service.gov.uk/ccp/signup/entrypage